This is a Forex trading course for beginners that guides and ensures that you become profitable while trading the markets, be it Forex, cryptocurrency, stocks, or any other market. However, we will focus on Forex trading in this course.

Forex simply means Foreign Exchange, where one trades one currency for another. A good example is that when one is traveling to another country, it is required that one trade their currency for the currency of the country they intend to travel to at the current exchange rate in the market. The global market allows traders to trade currencies against each other in pairs. For example, AUD/USD or CHF/USD. Using brokerage companies, traders can get a piece of this action by looking for profitable opportunities in the fluctuation of prices in the market.

What You Will Learn In This Forex Trading Course For Beginners

- What is forex?

- Candlesticks

- RSI, MACD, Fibonacci, and Elliot’s wave.

- Trend indicators; i.e.., Bollinger’s band, Envelopes, Moving Averages.

- Support and resistance

- How to use horizontal lines

- How to draw and use patterns

- Trend lines

- Scalping technique

- Using trends to predict the market

- How to use objects i.e, Fibonacci Retracements, Elliot Wave

- How to use multiple timeframes to predict the market

- How to use target profits

- How to trail stop loss

- Risk management

- Algo trading; using robots (expert advisors)

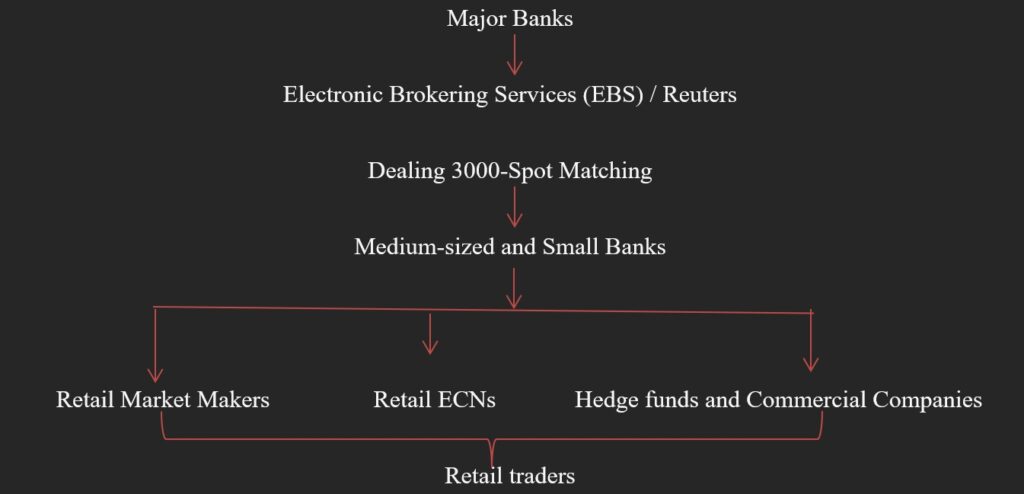

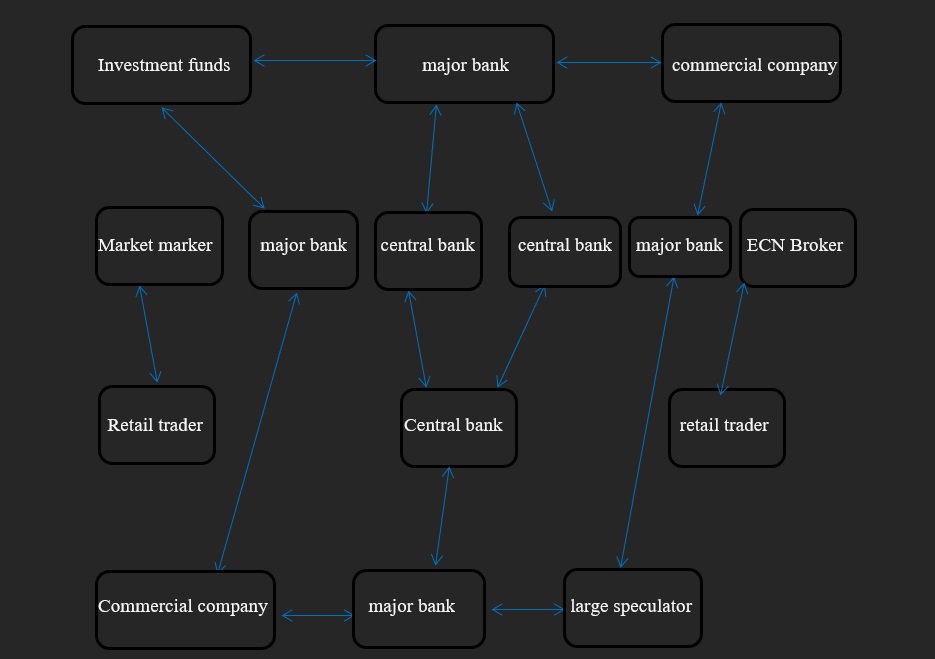

Forex Trading For Beginners – Market Heirachy

So, let’s see the connection between all these players:

Advantages Of Forex Trading

- High Liquidity

- Low barrier to entry

- Better risk management

- Trade anytime you want

- Low transaction cost

Forex Trading For Beginners – Best Sessions To Trade

- Asian (6 pm – 3 pm EST)

- London (3pm – 12am EST)

- New York (8 am- 5 pm EST)

The Best Session To Trade

For day trading

- London session

- London and New York (best time to trade)

Currency Pairs

It would be unwise to go any further talking about the foreign exchange if we didn’t mention the various currency pairs in the market. We will, however, focus on the main currencies in this Forex trading course for beginners.

The Different Currency Pairs(USD)

The Major Currency Pairs

- EUR/USD (Euro Dollar)

- GBP/USD (Pound Dollar)

- USD/CHF (Dollar Swiss)

- USD/JPY (Dollar Yen)

- AUD/USD (Aussie Dollar)

- NZD/USD (Kiwi Dollar)

- USD/CAD (Dollar Loonie)

The Cross Currency Pairs (non-USD)

- Euro Crosses

EUR/CHF, EUR/GBP, EUR/AUD

- Yen Crosses

EUR/JPY, GBP/JPY, AUD/JPY

- Pound Crosses

GBP/AUD, GBP/NZD, GBP/CAD

- Exotic Crosses

EUR/USD, USD/JPY, GBP/USD, USD/CHF

USD/CAD, AUD/USD, NZD/USD

Terminologies Used In This Forex Trading Course For Beginners

1. Long (bullish)/Short (bearish):

Long means that you will make profits if the price goes up (meaning you are buying) while short means that you will make profits if the price goes down. (Meaning you are selling).

2. Leverage and margin:

Leverage is how much larger you can trade relative to your account size; it is simply increased trading power that is not possible when using a margin account. It is expressed as a ratio between the money you really have in your account and the money that you can trade.

Margin is simply the amount of money that should be in your account for you to trade with certain leverage.

Margin= 100 / Leverage

3. Pip

This is a short form for points in percentage. It is a small measure of change in a currency pair in the market. For the USD (U.S. dollar), it is usually $0.0001; also known as 1/100th of 1% or one basis point. The size of the pip is standardized to secure your investment, as an investor, from huge losses.

In currencies, pips carry up to the fourth decimal, apart from the Japanese Yen, which carries up to the second decimal.

4. Bid and ask:

The bid is the price that you can sell at, while the ask is the price that you can buy at.

The bid is always lower than the ask. To realize the spread, just subtract the ask from the bid and get the number of pips.

Forex Lot Size

A lot size is basically the number of currency units that you are willing to sell or buy. Some brokers show their quantity in lots while others show it in actual currency units.

There are four main types of lots:

• Standard lot (100,000 units)

• Mini lot (10,000 units)

• Micro lot (1,000 units)

• Nano lot (below 1,000 units)

As you continue learning more in this Forex Trading course for beginners, you will definitely understand how lot size helps in risk management.

Bonus

Choosing a Broker is very important for your Forex Trading Career that’s why I recommend Super Forex. A Broker that I have used for the past 4 years. Create an account now Here.

Orders In Forex

There are four main orders in forex

- Market

- Limit

- Stop

- Stop loss

Market order

- This ensures that you enter the market now.

- Advantage; you know for sure you will be in the trade.

- Disadvantage: you pay a premium. (This is the amount paid for the contract)

Limit order

- The limit order ensures that you only get in if the market comes to your desired price. (pullback)

- Advantage: you enter at a “cheaper price”

- Disadvantage: you might miss the move; you’re trading against current momentum.

Stop order

- Enter only if the market moves in your favor (breakout)

- Advantage: enter trades with momentum.

- Disadvantage: might be a false breakout.

Stop loss order

- Exit the trade if it goes against you

- Advantage; cut your losses.

- Cons: the market reverses back in your direction.

Forex Charts

There are three popular charts, but you can decide for yourself which one suits you best. In this Forex trading course for beginners, we will be using Candle Sticks mostly, but it’s important to know the rest too. These charts are usually seen on platforms like Trading View and Meta Trader.

Line Chart

The line chart takes into consideration the closing price.

Bar Chart

The bar chart takes into consideration the open, high, low, and close prices.

Candle Stick Chart

The candlestick chart takes into consideration the open, high, low, and close (OHLC) and the color of the chart prices (for momentum). We will discuss this in our next lesson.

Forex Trading For Beginners – Types Of Analysis

There Are Three Types Of Forex Analysis

- Fundamental analysis

- Technical analysis

- Sentiment analysis

Fundamental Analysis

This type of analysis takes into account the GDP, interest rates, and non-farm payroll news, taking in the data and using it to predict the market.

It involves looking at the market by analyzing the economic, social, and political forces that may affect the supply and demand of an asset.

Technical Analysis

Technical analysis is a means of examining and predicting price movements in financial markets. It focuses on the study of price and volume. The traders deal with candlestick patterns, support and resistance levels, and Fibonacci ratios.

Sentiment Analysis

Reference: (https://forexfactory.com)

It focuses on quantifying the market sentiment.

For E.g., you can use the;

1, The commitment to traders’ reports; helps you anticipate market turning points,

2. Long/Short Ratio: Traders declare whether they are long or short, and you, as traders, seek out extremes and trade against the herd. It will give you a particular sentiment on the currency of a country.

Trading Strategies In Forex

There are three types of trading strategies in forex:

- Position trading

- Swing trading

- Day trading

Position Trading

- In this type of trading, one trades 4 hours and above. One should capture the meat of the trend.

- Suitable for those with full-time jobs.

- You don’t need to spend a lot of time in front of your screen

Swing Trading

- In this type of trading, one enters a trade between the 1 – 4 hour time frame.

- You’re trying to capture a “swing”/ move in the market.

- Suitable for those with full-time jobs.

Day Trading

- In this type of trading one trades below a 1-hour timeframe.

- Suitable for those who want to make forex trading their full-time job.

- The market must be watched closely most of the time closely.

- Trades are analyzed in a low time frame (30 minutes and 15 minutes).

- One tries to capture smaller opportunities to trade.

Forex Trading For Beginners – How To Select A Broker

Regulation

Ensure that your broker is regulated in the countries they are doing your business.

Execution

Pay attention to how the spreads move around just before major moves. A larger spread may out-stock you very fast.

Customer Service

Your broker should keep you updated on your account and progress. They should keep in touch.

Ease Of Withdrawal

The investor should be able to withdraw money from their account with ease without being given excuses by the broker. Let us look at how you will be able to protect yourself in this Forex Trading course for beginners.

And How Do You Protect Yourself?

1) Once you’re sure that the loss of your money is your broker’s fault, the first thing you should do is confront them to give you a good reason for the loss of your money.

2) If the broker does not give you a good reason for the loss, then bring it up with the relevant authorities.

3) You can also take your evidence to social media to discredit them.

Forex is like a game of tug-of-war where one team consists of the buyers and the other team consists of sellers, each trying to win the stalks. Forex trading is a very good opportunity to make good money and an investment that is worth it.

Bonus

To ask questions on anything you have not understood so far, head over to the Forum section, and our community will answer all your questions.

[…] to our blog post about the perceived similarities between Forex trading and multi-level marketing (MLM) schemes. Forex trading, also known as foreign exchange trading, […]

[…] Trading foreign currencies, or forex, is a popular investment activity that involves buying and selling different currencies in an attempt to make a profit. In recent years, the use of neural networks in Forex trading has gained popularity as a tool for predicting financial markets, including the forex market. […]

[…] hosting for Forex trading also offers more dependability in addition to improved performance and enhanced security. Forex […]

[…] from the comfort of your own home. But have you ever stopped to wonder about the history of forex trading before the internet came […]

[…] to our blog on the topic of “Order Flow and its Impact on Forex Trading in Nairobi.” Understanding order flow is critical for any trader attempting to navigate the […]